BTC Price Prediction: $200K Target in Play as Technicals and Institutional Demand Align

#BTC

- Technical Strength: Price above key moving averages with bullish MACD momentum

- Institutional Demand: Corporate treasury expansion (Marathon) and payment integration (Square) provide structural support

- Price Targets: Analysts like Tom Lee projecting $200K amid improving market structure

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

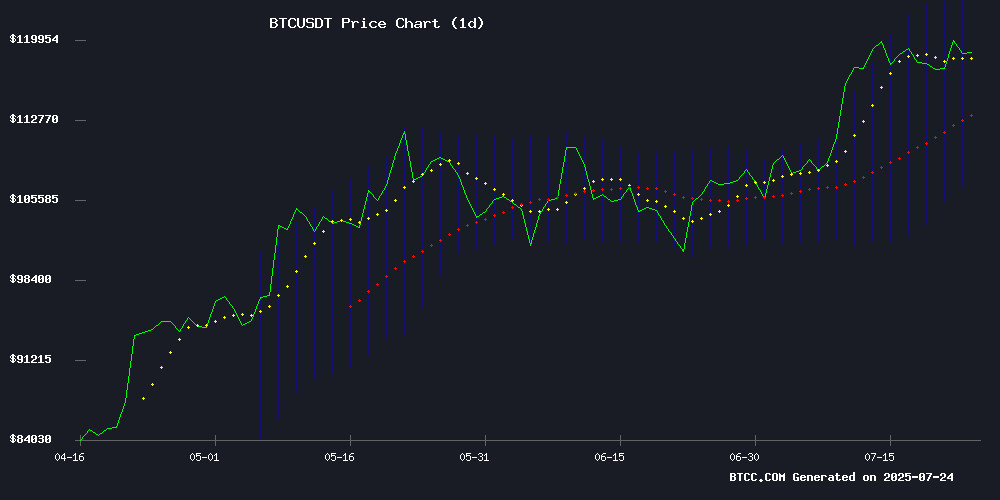

BTC is currently trading at $118,616, comfortably above its 20-day moving average of $115,950.50, indicating a bullish trend. The MACD histogram shows a slight positive momentum at 184.33, though the signal line remains in negative territory. Bollinger Bands suggest moderate volatility with the price hovering NEAR the upper band at $124,063.23. According to BTCC financial analyst William, 'The technical setup favors buyers as long as BTC holds above the $115,950 support level. A sustained break above $124,000 could trigger the next leg up.'

Institutional Adoption and Macro Sentiment Fuel BTC's Bull Case

Major catalysts include Block's S&P 500 inclusion with Lightning Network integration (enabling Bitcoin payments for 4M merchants) and Marathon's $1B debt offering to expand its BTC treasury. While Tesla maintained its $1.2B Bitcoin position, the reactivation of a 14-year-old wallet holding $468M in BTC created minor selling pressure. BTCC's William notes: 'Institutional adoption is accelerating faster than sell-side liquidity can absorb - the Square and Marathon news demonstrates real-world utility meets corporate treasury demand.'

Factors Influencing BTC’s Price

U.S. Government Holds Firm on Bitcoin Stash Amid Market Confusion

Arkham Intelligence has dispelled rumors of a massive Bitcoin sell-off by the U.S. government, confirming federal agencies still control over 198,000 BTC worth approximately $23.5 billion. The clarification followed a misleading disclosure from the U.S. Marshals Service, which reported holdings of just 28,988 BTC.

Blockchain data reveals the FBI, IRS, DEA, and Department of Justice collectively maintain one of the world's largest Bitcoin reserves. No movement has been detected in these wallets for four months, signaling the government's long-term position.

Senator Cynthia Lummis criticized initial reports of potential liquidation as a 'strategic blunder,' warning such action would compromise U.S. leadership in digital assets. The crypto community's brief panic underscores the market's sensitivity to institutional Bitcoin movements.

Tesla Maintains $1.2 Billion Bitcoin Holdings Amid Q2 Earnings Volatility

Tesla's latest earnings report reveals the company retained its 11,509 BTC position through Q2 2025, now valued at over $1.2 billion. The electric vehicle maker recorded a $284 million unrealized gain from its Bitcoin treasury as prices surged 30% during the quarter, climbing from $83,000 to $108,789.

The cryptocurrency's rally provided a rare bright spot for Tesla, which faces softening demand for its core EV products. Bitcoin's upward trajectory continues, trading at $118,714 at press time - a 0.25% daily gain that further bolsters Tesla's crypto assets.

New FASB accounting rules enabled Tesla to book these paper profits. The revised standards, effective since Q1 2025, require quarterly fair-value reporting of digital assets rather than the previous practice of recognizing only impairment losses. This regulatory shift offers investors greater transparency into corporate crypto holdings.

Bitcoin Consolidates Near Key Support as Analysts Eye Next Breakout

Bitcoin's price action has entered a consolidation phase, trading between $116,000 and $120,000 following its July surge to a record $123,200. The cryptocurrency now faces a critical test at the $116,000 support level, which analyst Kevinn Nguyen identifies as the linchpin for its next major move.

Market participants are watching for either a breakdown that could signal bearish momentum or a volume-backed rebound that might propel BTC toward $124,000. Some long-term projections suggest a seasonal target as high as $250,000 if bullish conditions persist.

Technical indicators show accumulation patterns forming on 4-hour charts, with the $116,000-$120,000 range becoming a battleground between buyers and sellers. The current mid-range positioning suggests the market awaits a catalyst for its next directional move.

Dormant Bitcoin Wallet Wakes Up After 14 Years, Worth $468 Million Today

A Bitcoin wallet holding 3,962 BTC, dormant since January 2011, has suddenly reactivated after 14.5 years. The stash, initially worth just $1,453 when Bitcoin traded at $0.393, now commands a staggering $468 million valuation.

The unexpected movement of such a long-idle position has sent ripples through the crypto community. This activity coincides with heightened market volatility, sparking speculation about the wallet owner's identity and intentions.

SunnyMining Launches High-Yield BTC Cloud Mining Contracts Amid Bitcoin's All-Time High

Bitcoin surged to a record $122,658 as optimism around U.S. crypto legislation and potential inclusion in 401(k) retirement plans fueled demand. The rally reinforces BTC's status as 'digital gold,' attracting global investors seeking inflation hedges.

SunnyMining capitalized on the momentum by introducing passive income-generating cloud mining contracts. The platform eliminates hardware costs and technical barriers, allowing users to deposit BTC for automated daily payouts. 'Let your BTC work for you' emerges as a market mantra amid growing interest in yield-bearing crypto strategies.

Bitzero Secures $25M Funding to Expand Sustainable Crypto Mining Operations

Bitzero, a cryptocurrency mining firm with backing from prominent investor Kevin O'Leary, has raised $25 million in fresh capital to scale its operations. The funding will be deployed to acquire 2,900 state-of-the-art Bitmain S21 Pro miners, significantly enhancing the company's mining capacity and operational efficiency.

The expansion signals robust investor confidence in Bitzero's sustainable mining model. The company differentiates itself through its use of hydroelectric and low-carbon energy sources across facilities in North America and Europe. This strategic investment is projected to generate an additional $10 million in annual revenue.

Block Joins S&P 500, Launches Bitcoin Payments via Square

Block Inc. (NYSE: XYZ), the fintech firm led by Jack Dorsey, has achieved dual milestones with its S&P 500 debut coinciding with the rollout of native Bitcoin payments through its Square subsidiary. The stock closed at $79.70 on July 24, marking a 14% weekly gain as markets reward its Bitcoin integration strategy.

The new service leverages Bitcoin's Lightning Network, enabling merchants to accept BTC transactions with near-instant settlement and minimal fees through existing Square hardware. Owen Jennings, Block's Head of Business, confirmed initial merchant onboarding via social media, signaling operational readiness for broader adoption.

This strategic move positions Block at the intersection of traditional finance and cryptocurrency innovation. The S&P 500 listing provides institutional validation while the Lightning implementation addresses Bitcoin's scalability challenges - a technical hurdle that has historically limited its utility for small-value transactions.

Square Launches Bitcoin Payments for 4 Million US Merchants via Lightning Network

Square has initiated a landmark rollout of Bitcoin payments for merchants through its point-of-sale systems, leveraging the Lightning Network for faster and cheaper transactions. The phased implementation began on July 22, 2025, with ambitions to onboard all 4 million Square merchants across the United States by 2026.

Merchants now have the flexibility to retain Bitcoin proceeds or convert them instantly to dollars, potentially halving processing fees compared to traditional credit card payments. Regulatory constraints currently exclude New York State and international markets from participation.

The announcement coincides with Block's ascension to the S&P 500 on July 23, accompanied by a 14% stock surge. Owen Jennings, a Block executive, heralded the milestone on social media, echoing sentiments from the company's May 27 unveiling at Bitcoin 2025 in Las Vegas.

FTX Sets September 30 Deadline for $1.9 Billion Creditor Payouts

FTX will initiate its next creditor distribution round on September 30, 2025, following court approval of a $1.9 billion release from disputed claims reserves. The Delaware bankruptcy court's decision to reduce reserves from $6.5 billion to $4.3 billion enables this payout, marking another phase in the exchange's restructuring process.

Nearly $6.2 billion has already been returned to creditors since distributions began earlier this year. Eligible claimants include holders of Class 5 Customer Entitlement Claims, Class 6 General Unsecured Claims, and select Convenience Claims. The August 15, 2025 registration cutoff looms for those seeking inclusion.

Controversy persists around valuation methods, with repayments pegged to November 2022 crypto prices—a period when Bitcoin traded between $16,000-$20,000. This snapshot valuation frustrates creditors eyeing current market premiums, creating a stark disparity between recovery amounts and potential present-day asset values.

MARA Holdings Announces $1 Billion Debt Offering to Expand Bitcoin Treasury

MARA Holdings has unveiled plans to raise $1 billion through zero-coupon convertible notes, signaling one of the most aggressive corporate Bitcoin accumulation strategies since MicroStrategy's landmark purchases. The mining firm will initially offer $850 million in senior unsecured notes due 2032, with an option for an additional $150 million placement to qualified institutional buyers.

The capital structure play serves dual purposes: $50 million will retire higher-cost 2026 debt obligations, while the balance fuels further Bitcoin acquisitions. MARA's treasury already holds 50,000 BTC—second only to MicroStrategy's stockpile—and this debt offering could position the company as the institutional leader in Bitcoin adoption.

Convertible notes allow MARA to access cheap capital while giving investors optionality to participate in equity upside. The zero-interest structure reflects strong institutional demand for crypto-correlated instruments, particularly from hedge funds and family offices seeking non-dilutive exposure.

Bitcoin Tests Key Support as Analyst Tom Lee Projects $200K Target

Bitcoin consolidates near $118,000-$118,600 after touching $123,000 highs, maintaining a bullish flag pattern that could propel it toward $140,000 if support at $112,000 holds. The RSI reading of 48.88 leaves room for upward momentum without immediate overbought risks.

Fundstrat's Tom Lee doubled down on his $200,000-$250,000 price target during a CNBC appearance, framing Bitcoin as 'Digital Gold' capable of capturing 25% of gold's market capitalization. Regulatory tailwinds like the GENIUS Act approval may catalyze this trajectory.

Critical resistance levels loom at $120,000 and $120,250, while the $118,200 trendline provides near-term support. Market structure suggests accumulation at current levels as institutional interest grows.

Is BTC a good investment?

Based on current technicals and market structure, BTC presents a compelling risk/reward profile:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +2.3% premium | Bullish momentum intact |

| MACD Histogram | Positive crossover | Short-term upside bias |

| Bollinger Band Position | Upper band test | Volatility expansion likely |

William at BTCC emphasizes: 'With institutional adoption accelerating (Square, Marathon) and Tom Lee's $200K price target gaining traction, BTC remains a high-conviction hold for investors comfortable with crypto volatility.'

1